I came at this, as always, as a selfish kiwi. I want NZ to get more benefit from it’s assets than other countries do. If the profits from NZ assets stay in NZ we could have lower tax rates as the tax base increases. But that is not what this is about, this about trying to identify why overseas purchases will pay more for something in NZ than a NZer would.

Beyond the obvious supply & demand curve that implies when there is more demand for something the price goes up, google it if you need more info, there is also the reduced cost of capital variance that some overseas entities have which means they are able to pay more for a NZ asset than a Kiwi entity.

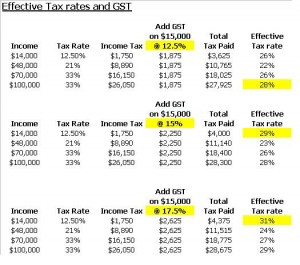

An interest rate in one country of 7% vs NZ’s interest rate of 10.2% means that someone able to borrow at 7% will pay up to 31% more for the same asset. On a multi million dollar piece of prime farming land this means the farmer can retire 10 years earlier to his B&B in the mount with a couple of rentals on his tax free capital gains …. whoops I mean the tax free capital gains that his trust earned (that will be another rant).

See the attached for a list of current business loan interest rates at some of our major trading partners and how they affect the price of an investment asset.

Please note that I am pretty much against all foreign ownership of land, including NZ’s ownership of land in other countries especially now I’ve crunched the numbers…. more in my next blog.